Insurance for businesses or sole traders that deal with vehicles of all types is important, but if you are new to the motor industry, you may not know exactly what kind of insurance cover is available.

Here is a quick rundown of three motor trade insurance options that you can buy and the benefits that each brings to the table.

Road risk insurance

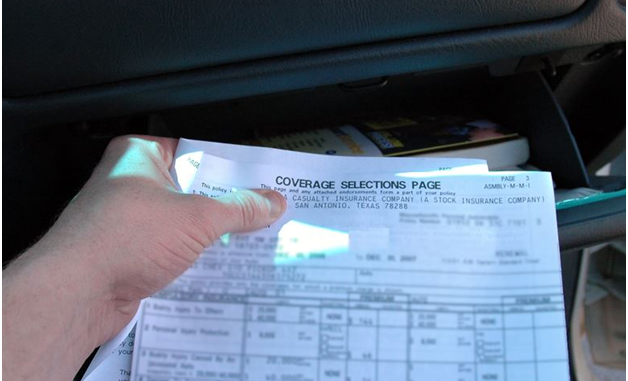

If you have every insured a car for your own personal use, then you will be right at home with road risk insurance. It is broken down into third party only, third party fire and theft and comprehensive cover, with policy pricing reflecting the amount of cover that is included.

In essence, road risk insurance will protect you or your employees while they are driving customer cars, which is why it is required by law.

Liability insurance

Whether you work with cars, or sell them, liability insurance will cover you against a range of potential problems that might arise.

There are several different variations of liability insurance, allowing you to cover products like car parts against manufacturing faults, vehicles and equipment stored on-site and, of course, employees themselves.

Organisations with workers are legally obliged to get employer’s liability cover, whether or not they are full or part time members of the team. It is always sensible to check the specific legislation and regulations that apply, as being caught out could be costly in the short term, as well as having long term ramifications for the reputation of your organisation and its ability to operate.

Combined insurance

With an all-encompassing motor trade insurance policy, you can get inclusive cover across all of the aforementioned areas, while benefitting from a more cost-effective and value-oriented approach to pricing.

Combined insurance policies can still be flexible, so you never need to pay over the odds for cover that simply does not apply to your organisation. So whether you do nothing more than offer a car washing service to customers, or you provide vehicle sales and repairs, a unified policy can be an excellent pick.

Of course, you may well need some guidance when it comes to establishing exactly what kind of insurance you require for your business. It is never sensible to rush into this process without consulting an expert first.